The Sensex and Nifty sprinted to all-time highs for the fifth session on the trot on Thursday, in tandem with global markets, after the US Federal Reserve’s accommodative stance further fuelled risk-on sentiment.

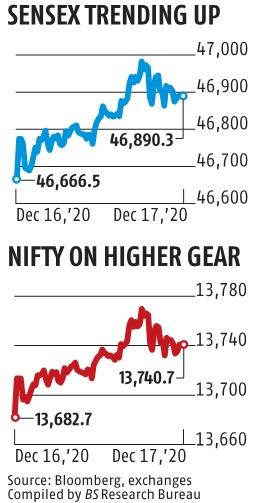

After touching its lifetime intra-day high of 46,992.57, the Sensex settled 223.88 points or 0.48 per cent up at 46,890.34 — its new closing record.

Similarly, the broader Nifty rose 58 points or 0.42 per cent at a new closing high of 13,740.70. It hit a lifetime peak of 13,773.25 during the day.

HDFC topped the Sensex gainers’ chart, spurting 2.92 per cent, followed by Bajaj Finance, HDFC Bank, IndusInd Bank, UltraTech Cement, PowerGrid, TCS, Tech Mahindra, and L&T.

On the other hand, ONGC, Maruti, Tata Steel, HUL, Bajaj Auto, and Sun Pharma were among the main laggards, tumbling up to 1.55 per cent.

Global stocks soared to fresh highs after the US Fed said it would continue with its massive monetary stimulus until it sees “substantial further progress” in employment and inflation levels.

The US central bank also vowed to maintain its monthly bond purchases of at least $120 billion.

ALSO READ: MF space set for digital disruption with likely entry of tech-heavy AMCs

“The market is rallying on the affirmation of the US FOMC policy decision to keep rates unchanged and assurance of continued support through further stimulus until the economy reaches the employment and inflation target. Along with this, the market is inching higher on expectations of upcoming events like further stimulus packages, Brexit progress and vaccine developments,” said Vinod Nair, head (research), Geojit Financial Services.

Sector-wise, the BSE finance, capital goods, realty, bankex, industrials, energy and health care indices rose up to 1.01 per cent, while metal, oil and gas, utilities, FMCG, and auto lost as much as 1.42 per cent.

In the broader markets, the BSE MidCap and SmallCap fell up to 0.23 per cent.

Elsewhere in Asia, bourses in Shanghai, Hong Kong and Tokyo ended with gains, while Seoul was in the red.

Stock exchanges in Europe were also largely trading on a positive note.

The global oil benchmark Brent crude futures rose 0.51 per cent to $51.34 per barrel.

In the forex market, the Indian rupee ended just 1 paisa lower at 73.59 against the greenback.

Foreign portfolio investors (FPIs) remained net buyers in the capital markets, purchasing equities worth Rs 1,982 crore on Wednesday, according to provisional exchange data.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

First Published: Fri, December 18 2020. 00:46 IST

read the full story about Indices’ winning streak continues on US Fed stance; HDFC rises 2.9%

#theheadlines #breakingnews #headlinenews #newstoday #latestnews #aajtak #ndtv #timesofindia #indiannews