The deal flow in 2019 has been good with each successive quarter being better than the preceding one

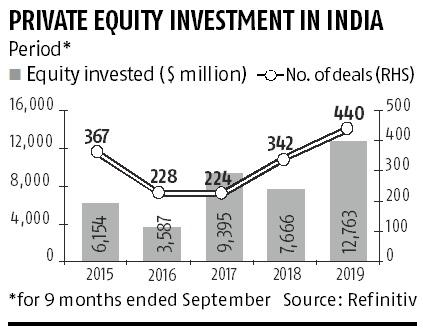

Private equity (PE) investment in India for the first nine months of the year stood at $12.8 billion, according to data from Refinitiv. This is the highest investment in the past six years for comparable periods for which data was analysed.

There have been three PE exits in Indian companies through initial public offerings (IPOs) this year. PE exits via IPOs had picked up pace in 2017 and the early part of 2018 before a slump in IPOs halted these exits. For instance, 84 per cent of the Rs 42,000-crore raised in 2017-18 has came in via offer for sales. In an offer-for-sale, promoters, PE or venture capital players offload or dilute their stake, effectively leading to a change in the ownership of shares.

There were six secondary sales in 2019, compared with eight in the previous year and three the year before, according to Refinitiv data.

In keeping with the global trend of larger funds and bigger deals, PE growth in India has been fuelled by an expansion in deal sizes, as general partners seek larger deals, according to experts.

“Private equity investors take a longer term view on businesses and view the current slowdown as more cyclical than structural and have used the opportunity over the last few quarters to invest in high quality companies in consumer, financial services and digital sectors as well as operationally stable infrastructure assets which have been more resilient to slowdown,” said Puneet Renjhen, executive director, Avendus Capital.

Major deals this year include Carlyle Group buying 9 per cent stake in SBI Life Insurance for about $652 million in its biggest-ever investment in India. Other significant deals include Baring PE buying into NIIT Technologies and Brookfield Asset Management buying Pipeline Infrastructure.

The deal flow in 2019 has been good with each successive quarter being better than the preceding one. “With increasing interest from large global pension and sovereign wealth funds combined with evolution of new investment structures like InvITs and REITs, we continue to project sustained growth in real asset investments in India,” a report by EY India said.

First Published: Fri, November 01 2019. 02:15 IST

read the full story about Private equity investments in India at $12.7 billion in 2019: Refinitiv

#theheadlines #breakingnews #headlinenews #newstoday #latestnews #aajtak #ndtv #timesofindia #indiannews