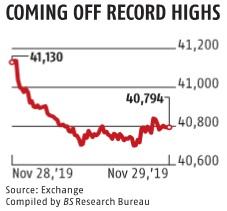

Sensex fell 336 points, or 0.82 per cent, to end at 40,794; Nifty closed at 12,056, down by 95 points or 0.8 per cent

The Sensex eased off from its record highs as investors took money off the table in anticipation of weak economic data. Weakness in the global markets amid fresh trade tensions between the US and China further weighed on sentiment. After logging record highs in the previous three trading sessions, the Sensex fell 336 points, or 0.82 per cent, to end at 40,794.

The Nifty closed at 12,056, down by 95 points or 0.8 per cent. Gains in index heavyweights amid sustained foreign flows had helped both the indices log new highs in the past few sessions, even as economic growth projections remained uninspiring. The economic growth data released after market hours showed that gross domestic product (GDP) grew at 4.5 per cent for the September quarter (Q2), its weakest growth in more than six years.

Experts said the weak GDP front print is a culmination of several indicators including falling automobile sales, tepid corporate earnings growth, and shrinking factory output. Market players said sluggish economic growth could limit market upside.

“Further, weakness in the underlying economy as well as slower earnings growth leave limited room for upside,’ said Siddhartha Khemka, head (retail research, Motilal Oswal Financial Services.

Earlier this month, Moody’s had revised India’s credit rating outlook citing growth concerns. The rating agency said the economic growth could remain materially lower than in the past, and that the government could face significant constraints in maintaining the fiscal deficit and preventing the rising debt burden.

Market participants said that after Moodys downgraded India’s growth outlook, many domestic brokerages also lowered their GDP expectation for FY20, echoing the fact that there is a consistent slowdown in the absence of any growth levers.

“Profit booking ahead of economic data and selling pressure in Asian peers due to the risk of retaliation from China added volatility in the market. The recent rally has lifted the market to supreme valuation, which may limit the headroom of key indices to perform well in the short-term,” said Vinod Nair, head of research, Geojit Financial Services. Overseas investors, who have been strong buyers in the past two months, were seen turning negative. They sold shares worth nearly Rs 2,000 crore, provisional data provided by stock exchanges showed.

Barring four, all members of the Sensex pack fell. Reliance Industries, which fell 1.84 per cent, contributed most to the index fall. ICICI Bank fell 1.4 per cent, and Hindustan Unilever fell 2.37 per cent — the third biggest contributor to the index’s fall.

Barring four, all 19 sectoral indices of the BSE ended the session with losses. The decline was led by gauge for energy stocks that fell 1.5 per cent and the metal index , which fell 1.30 per cent. Foreign portfolio investors have pumped in over Rs 40,000 crore in the past two months, thanks to a benign monetary policy by global central banks and reform measures by

the government.

In the past few months, the Centre has come out with several measures, including a corporation tax cut and a special real estate fund to boost sentiment. It has also announced the merger of public sector banks and privatisation of public sector enterprises. Meanwhile, the central bank has cut the benchmark policy rate by 135 bps in this year, to help bolster liquidity.

First Published: Fri, November 29 2019. 22:55 IST

read the full story about Sensex falls 336 pts ahead of GDP data; FPIs sell shares worth Rs 1,900 cr

#theheadlines #breakingnews #headlinenews #newstoday #latestnews #aajtak #ndtv #timesofindia #indiannews