Titan cut growth guidance for H2FY20 to 11-13%, from 20%, on account of weak outlook for the jewellery business

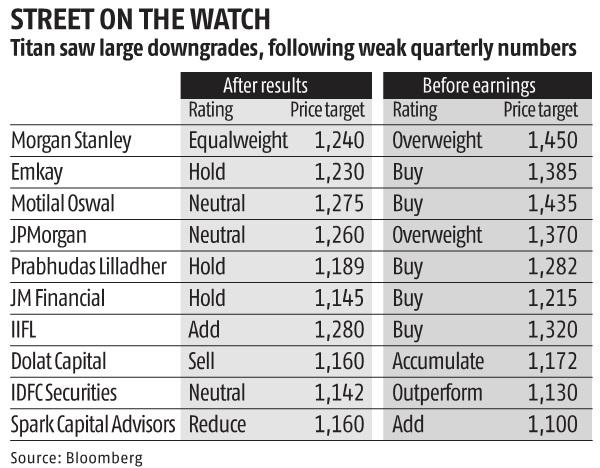

The Titan stock plunged 10% on Wednesday, as analysts de-rated the stock following weak Q2 results. The stock ended at Rs 1,154, down Rs 130, on the NSE. The firm’s Q2 earnings came in sharply below Street estimates. Further, Titan cut growth guidance for H2FY20 to 11-13%, from 20%, on account of weak outlook for the jewellery business. CLSA downgraded the stock to ‘sell’, with a price target of Rs 1,025, slashing earnings estimates by 12%. Morgan Stanley, too, downgraded the stock and cut the price target from Rs 1,450 to Rs 1,240. Analysts said Titan is trading at premium valuations and hence, there is little room for disappointment.

“The stock has almost doubled in two years and also rallied by 12% since the corporate tax cut. This in turn makes it appear expensive at 57.6x its estimated earnings for 2020-21, leading us to downgrade to neutral (targeting 50 times September 2021 estimated earnings),” said Motilal Oswal in a note.

First Published: Thu, November 07 2019. 01:08 IST

read the full story about Titan plunges 10% as analysts de-rate stock following weak Q2 results

#theheadlines #breakingnews #headlinenews #newstoday #latestnews #aajtak #ndtv #timesofindia #indiannews